Officially this is my last T40 blog post for the year as I'm finishing off on the trading front come 24 December and breaking till 04 January. I'll save the new year's messages for a post I'm planning towards the tail-end of next week but will say Merry Xmas to anyone who's still meandering around forums and blogs at this time of the year. I trust you will have a great Xmas and a relaxing time with family and friends.

Reflecting back on the past week, in last week's post I made the point that we would need to exercise caution with all the economic and political happenings playing out. And it was fairly choppy week all in all with some significant up and down moves. On balance, while the week officially ended in the green, looking at the weekly candle, we can see the choppiness reflected in a long wick and tail and with a forward looking view, the bears may still have it by virtue of that long wick. However the weekly stochastic is oversold (although not reversing yet) and the RSI has started to pip back upwards. Also as noted in last week's post, if the prior week low can hold, we could see some critical, much needed positive divergence being brought into play here.

So the weekly charts still remain mixed but if a solid positive candle can be formed in the week ahead, the bulls could just nose ahead on a medium-term basis.

On the daily chart, we can see how the breakout target area was met and the market then rallied fairly strongly before taking a pounding on Friday to close the week. The stochastic remains pointing to further upside in the near-term but should there be a bearish start to the new week, we could see a failed stochastic reversal coming into play. Also looking at the chart patterns, a weak start could see the T40 conforming to the draft rising wedge pattern marked up on the chart with potential downside towards the 43,000 level. Conversely a break above 45,000 would be needed to negate the wedge formation.

The daily closing support and resistance has not changed much since last week with range trades available between 45,300 and 42,400 or thereabouts.

So overall, my view is that things remain in a fine balance. With reduced liquidity in the market leading up to Xmas, caution should still be maintained with additional spreads being factored into risk and dynamic trade sizing. However, with us currently slap-bang in the trading range I'd feel comfortable letting positions run in either direction especially with the major volatility events out of the mix for the balance of the year (touch wood!) depending on whether the bulls or bears take an early lead, this bias may shift and I'll reflect that in the commentary section.

Sunday, December 20, 2015

Sunday, December 13, 2015

Perspectives 14 December 2015

In last week's Perspectives post, I painted a scenario of short-term consolidation followed by the potential for further weakness on the cards. The consolidation element of this viewpoint was fairly short-lived with the fallout of highly publicised political shenanigans providing the catalyst for the anticipated weakness to start playing out in rather dramatic fashion towards the tail-end of the week. The result is that triangle breakout identified last week has nearly played out and we are now fast approaching the breakout target area which was identified between the 42,500 and 43,000 levels.

Looking at the current weekly chart, we now see that last week's entire candle body painted below the 89 week EMA. In last week's post we referenced the fact that this has only happened in 3 stages since the end of 2009 and this is relevant historical information to keep in mind as we move into the year-end. From the graph we can also see that the weekly stochastic is now oversold but still firmly pointed downwards. Interestingly if it can create a swing low here, we could see the potential for positive divergence being formed on a weekly basis - this is still to be confirmed though. At present both the slope of the stochastic as well as the positioning of the RSI still points to the potential for further weakness.

The daily chart shows the progression towards the breakout target area noted above and of interest will be whether the market can find support around these levels. With the future closeout pending for this week a move below 43,000 could see further sell-off at this significant options level. The stochastic looks to have found a base with the potential for some consolidation/ bounce playing out.

On the daily support & resistance graph we can see that there is clear room to fall towards the 42,500 level unless a support level can be established in the near-term.

Factoring in uncertain elements like the FOMC interest rate decision on Wednesday night and the futures closeout on Thursday, the continued currency and local market fallout in the wake of the cabinet changes taking place, combined with a local public holiday on Wednesday and the week ahead is going to be one of the most fascinating from an analysis perspective. For the last 2 years we saw continued weakness into the closeout followed by a rally into the year-end. But circumstances are undoubtedly fundamentally different this time around.

My view on this would be that we would need strong consolidation out of the blocks to prevent further weakness over the course of the week or there is a high probability that we will see the T40 fall further into the target zone highlighted above and then towards the 42,500 support level. If that scenario plays out it may well negate the potential for positive divergence on a weekly basis and the rather bearish proposition set out in the weekly 3LB chart here could be on the cards. Alternatively, if the market could find some form of support here - especially a consolidation above 43,500 we may see this start to base out for a short rally or sideways chop into the year-end.

Either way trading the next few days on the T40 demands extreme caution. On balance my view remains bearish and I will look to trade intraday moves quickly on both the long and short side with compressed targets to take quicker profits. Another risk management measure I will look to implement with a bearish bias in mind is to half risk size on the long side leading up the futures closeout.

Looking at the current weekly chart, we now see that last week's entire candle body painted below the 89 week EMA. In last week's post we referenced the fact that this has only happened in 3 stages since the end of 2009 and this is relevant historical information to keep in mind as we move into the year-end. From the graph we can also see that the weekly stochastic is now oversold but still firmly pointed downwards. Interestingly if it can create a swing low here, we could see the potential for positive divergence being formed on a weekly basis - this is still to be confirmed though. At present both the slope of the stochastic as well as the positioning of the RSI still points to the potential for further weakness.

The daily chart shows the progression towards the breakout target area noted above and of interest will be whether the market can find support around these levels. With the future closeout pending for this week a move below 43,000 could see further sell-off at this significant options level. The stochastic looks to have found a base with the potential for some consolidation/ bounce playing out.

On the daily support & resistance graph we can see that there is clear room to fall towards the 42,500 level unless a support level can be established in the near-term.

Factoring in uncertain elements like the FOMC interest rate decision on Wednesday night and the futures closeout on Thursday, the continued currency and local market fallout in the wake of the cabinet changes taking place, combined with a local public holiday on Wednesday and the week ahead is going to be one of the most fascinating from an analysis perspective. For the last 2 years we saw continued weakness into the closeout followed by a rally into the year-end. But circumstances are undoubtedly fundamentally different this time around.

My view on this would be that we would need strong consolidation out of the blocks to prevent further weakness over the course of the week or there is a high probability that we will see the T40 fall further into the target zone highlighted above and then towards the 42,500 support level. If that scenario plays out it may well negate the potential for positive divergence on a weekly basis and the rather bearish proposition set out in the weekly 3LB chart here could be on the cards. Alternatively, if the market could find some form of support here - especially a consolidation above 43,500 we may see this start to base out for a short rally or sideways chop into the year-end.

Either way trading the next few days on the T40 demands extreme caution. On balance my view remains bearish and I will look to trade intraday moves quickly on both the long and short side with compressed targets to take quicker profits. Another risk management measure I will look to implement with a bearish bias in mind is to half risk size on the long side leading up the futures closeout.

Thursday, December 10, 2015

Sappi long and Clicks short

With the shenanigans of the past 24 hours creating a lot of volatility across the board I was initially reluctant to post these trades as the outcomes appear quite remote at face value. However, as the system has been stress tested across a range of market conditions, far be it for me to start second guessing at this point and to allow market volatility fear to prevent the pulling of the figurative trigger should potential trades be triggered tomorrow. Having said that, overall open risk should and will also be evaluated and that would be a factor for consideration pre- entering either of these positions.

SAP: Long entry zone between R63.23 and R60.24 with a stop as a close below R57.24 and upside targets at R69.22/R75.21 and R78.21

***********

CLS short entry zone between R83.45 and R87.68 with a stop as a close above R91.91 and downside targets at R74.99/R66.53 and R62.30

***********

SAP: Long entry zone between R63.23 and R60.24 with a stop as a close below R57.24 and upside targets at R69.22/R75.21 and R78.21

***********

CLS short entry zone between R83.45 and R87.68 with a stop as a close above R91.91 and downside targets at R74.99/R66.53 and R62.30

Monday, December 7, 2015

Pick n' Pay long and Telkom short setups

With the 21 week EMA well above the 89 week EMA, despite the bearish candle painted last week, the longer-term trend on PIK still looks fairly stable setting a series of higher lows over the past 6 months . The stochastic does have a slightly bearish bias but its in a fairly neutral zone at the moment.

Drilling down into the daily chart, we see that price has retraced from the last localised high achieved in the last week of November and then found support at the 100% retracement level resulting in a hint of positive divergence as price made a lower low while the stochastic made a slightly higher low. The stochastic is also oversold and looks to be reversing upwards towards its signal line.

On the support and resistance daily graph we see that price appears to be finding support at an upward sloping trend-line going back to June 2015

TKG is a standard 3LB short setup with the 3LB breaking down below its previous swing low creating a sell zone between R57.90 and R59.70 with a stop as a close above R61.50 and downside targets at R54.30/R50.70 and R48.90

Drilling down into the daily chart, we see that price has retraced from the last localised high achieved in the last week of November and then found support at the 100% retracement level resulting in a hint of positive divergence as price made a lower low while the stochastic made a slightly higher low. The stochastic is also oversold and looks to be reversing upwards towards its signal line.

On the support and resistance daily graph we see that price appears to be finding support at an upward sloping trend-line going back to June 2015

As indicated in the graph above, I'm going to trade this by looking to buy into further strength at an entry around R64.20 (above today's high) looking for a move back to overhead resistance at R68.50 with a stop set as a close below R62.70 (previous swing low) yielding a target reward-risk of 2.9-1. In the context of overall market weakness and the slightly bearish bias developing on the weekly chart I'd grade this trade at 75% of maximum risk.

*******************

Sunday, December 6, 2015

PPC Short setup

I missed an entry on PPC the last time it gave a short setup on this basis but a fresh signal came through with the 3LB breaking its previous low on Friday. The entry zone is between R15.02 and R15.36 with a stop as a close above R15.69 and downside targets at R14.35/R13.68 and R13.35.

Perspectives - 06 December 2015

Following last weekend's analysis, it was the bears who took the center stage over the course of the week as we saw the breakdown out of the triangle pattern which was highlighted increase in downward momentum as the week moved to a close with the envisaged support zone between the 45,300 to 45,500 level not even slowing the descent down.

Looking at where we stand at the moment, the weekly chart shows the close below the 89 week EMA which has happened at only 3 stages since October 2009 (when the 21 week EMA crossed above the 89 week EMA). The weekly stochastic remains bearish pointing firmly downwards and has room to fall before being regarded as oversold.

On the daily chart we can see the triangle breakout projected down to the 42,500 - 43,000 zone. However, the stochastic has flattened and may be reversing which could be indicative of short-term consolidation in the week ahead.

The daily support and resistance shows the previous support level around 45,3000 now shown as overhead resistance as we closed at minor 44,400 support. This minor support could potentially be the catalyst for short-term consolidation as noted above. However, we also need to look at the next major support as reflected by the slowly rising blue line in the chart. Again, this points to potential support only coming in around the 42,500 level.

Putting this all together, it appears as if there is a potential for near-term consolidation in the making but unless the T40 manages to regain major support above 45,300 we would look down towards 42,500 - 43,000 as a probable target area. For intraday trading we will therefore allow the shorts to run while taking quick profits on any long positions. I may also look for a potential short entry on a longer-term basis on a consolidation pullback within the next week or so if an acceptable reward-risk can be established.

Looking at where we stand at the moment, the weekly chart shows the close below the 89 week EMA which has happened at only 3 stages since October 2009 (when the 21 week EMA crossed above the 89 week EMA). The weekly stochastic remains bearish pointing firmly downwards and has room to fall before being regarded as oversold.

On the daily chart we can see the triangle breakout projected down to the 42,500 - 43,000 zone. However, the stochastic has flattened and may be reversing which could be indicative of short-term consolidation in the week ahead.

The daily support and resistance shows the previous support level around 45,3000 now shown as overhead resistance as we closed at minor 44,400 support. This minor support could potentially be the catalyst for short-term consolidation as noted above. However, we also need to look at the next major support as reflected by the slowly rising blue line in the chart. Again, this points to potential support only coming in around the 42,500 level.

Putting this all together, it appears as if there is a potential for near-term consolidation in the making but unless the T40 manages to regain major support above 45,300 we would look down towards 42,500 - 43,000 as a probable target area. For intraday trading we will therefore allow the shorts to run while taking quick profits on any long positions. I may also look for a potential short entry on a longer-term basis on a consolidation pullback within the next week or so if an acceptable reward-risk can be established.

Thursday, December 3, 2015

Short setup on Nedbank

This is the second setup on the short side for Nedbank in less than a month. I missed entry on the previous occasion as it moved out of the blocks too quickly and in the context of the overall market weakness there may well be another downward surge away from our entry point tomorrrow however, the setup details are as follows as a result of the 3LB breaking its previous swing low: Entry zone between R201.53 and R203.99 with a stop in as a close above R206.44 and downside targets at R196.62/R191.71 and R189.26

Wednesday, December 2, 2015

Some more short setups - KIO and GRT

The resource sector doesn't need any further downside but there's technical 3LB breakdown coming through on KIO as per the chart below yielding an entry zone on the short side between R40.11 and R42.51 with a stop as a close above R44.90 and downside targets at R35.32/R30.53 and R28.14. Calling a bottom in these things does appear to be an exercise in futility....

Another sector which has been taking strain of late as we lead into the rising interest rate cycle is the property sector and with us already trading breakouts on Refine as well as Attacq, I'm actually getting a bit concerned about overconcentration in this space. But for completeness, this is the setup on GRT which has now materialised as well. Details as follows: Entry zone on the short side between R23.80 and R24.13 with a stop as a close above R24.45 and downside targets at R23.15/R22.50 and R22.18.

Another sector which has been taking strain of late as we lead into the rising interest rate cycle is the property sector and with us already trading breakouts on Refine as well as Attacq, I'm actually getting a bit concerned about overconcentration in this space. But for completeness, this is the setup on GRT which has now materialised as well. Details as follows: Entry zone on the short side between R23.80 and R24.13 with a stop as a close above R24.45 and downside targets at R23.15/R22.50 and R22.18.

Tuesday, December 1, 2015

Attacq short setup

Interesting how the property stocks seem to be popping up on a breakout basis at the moment. Here we have the 3LB on ATT breaking its previous swing low setting up a short entry zone between R20.14 and R20.47 with a stop in as a close above R20.80 and downside targets at R19.48/R18.82 and R18.49

Sunday, November 29, 2015

T40 Perspectives 29 November 2015

The T40 spent most of last week bumping up against but failing to comprehensively break the 47,000 level we've been eyeballing as a key resistance level to crack for the further upward move.

Looking at the weekly chart we see that the stochastic has worked off its overbought condition but is still pointing firmly downwards. The weekly candles really only reflect the sideways chop consolidation the market has been experiencing over the past few weeks making it difficult to see a clear direction materialising.

Countering this outlook is the potential recurring seasonal impact of the "santa clause rally". Looking back at the past 2 years, its worth noting that this has kicked in later and later with the market pivoting off a low in the week of 13 December and 17 December in 2013 and 2014 respectively. From that perspective, we still have a couple of weeks of further potential weakness in the making at least assuming we have a breakdown playing out here.

Worth noting at this point is also a post I did on twitter a few weeks back

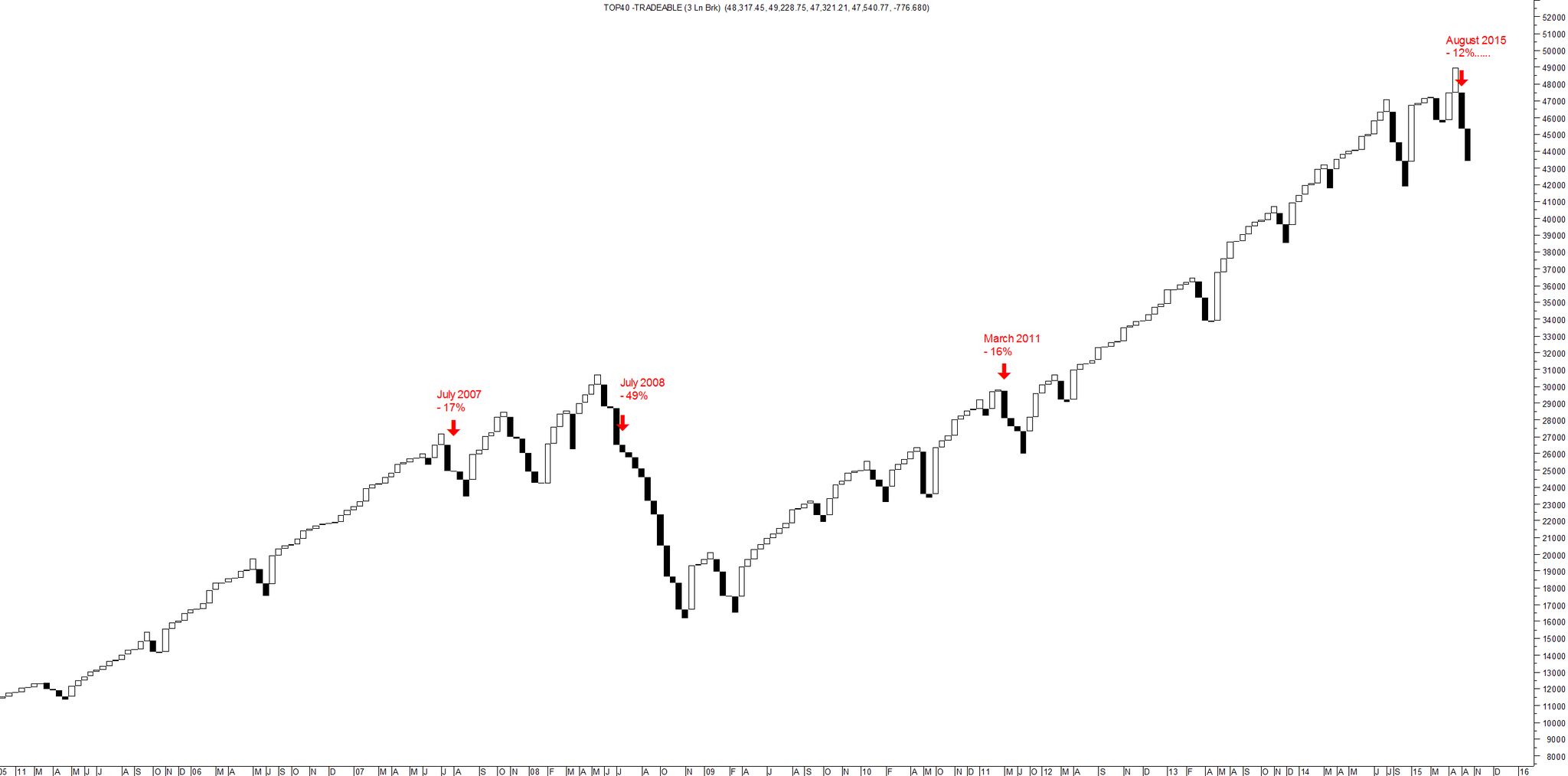

What this shows is the % drop from high to low that the market took following a break of the swing low on a 3LB weekly chart. Interestingly, in the last 10 years, the weekly 3LB has only broken down 4 times (July 07, July 08, March 11 and then most recently in August 2015). Of all of these, the high to low originating in August 2015 has to date been the the most moderate with the market reversing but only 12%. Again nothing conclusive can be drawn form this observation but it adds another notch to the bearish outlook that further downside could be on the cards.

Drilling into the daily chart, we can see the T40 in a consolidation holding pattern at the moment with the stochastic meandering a bit aimlessly in neutral territory. There's also a slightly disturbing potential triangle formation in the making which if breaking down, could see a significant downside move in the making.

The daily closing support and resistance view shows how the 47,000 level has resisted the upwards break as the T40 remains range-bound within the major channel as highlighted.

Overall its not a clear picture at the moment. The potential for downside over the next couple of weeks appears real unless the market can find support around the 46,000 level again. If that support level fails the 45,300 area will be critical or we may see the triangle break highlighted above playing out and could well see the prior lows being revisited int he medium-term. On the flip-side, if the T40 could break and hold the 47,000 level, the bulls could force the year-end rally to play out with potential for further upside back towards historical highs. In the short-term we'll trade this analysis by keeping targets tight and fixed while we're in the 45,500 to 47,000 range for both longs and shorts. If we breakout of that range we'll be more inclined to let trades run.

Looking at the weekly chart we see that the stochastic has worked off its overbought condition but is still pointing firmly downwards. The weekly candles really only reflect the sideways chop consolidation the market has been experiencing over the past few weeks making it difficult to see a clear direction materialising.

Countering this outlook is the potential recurring seasonal impact of the "santa clause rally". Looking back at the past 2 years, its worth noting that this has kicked in later and later with the market pivoting off a low in the week of 13 December and 17 December in 2013 and 2014 respectively. From that perspective, we still have a couple of weeks of further potential weakness in the making at least assuming we have a breakdown playing out here.

Worth noting at this point is also a post I did on twitter a few weeks back

What this shows is the % drop from high to low that the market took following a break of the swing low on a 3LB weekly chart. Interestingly, in the last 10 years, the weekly 3LB has only broken down 4 times (July 07, July 08, March 11 and then most recently in August 2015). Of all of these, the high to low originating in August 2015 has to date been the the most moderate with the market reversing but only 12%. Again nothing conclusive can be drawn form this observation but it adds another notch to the bearish outlook that further downside could be on the cards.

Drilling into the daily chart, we can see the T40 in a consolidation holding pattern at the moment with the stochastic meandering a bit aimlessly in neutral territory. There's also a slightly disturbing potential triangle formation in the making which if breaking down, could see a significant downside move in the making.

The daily closing support and resistance view shows how the 47,000 level has resisted the upwards break as the T40 remains range-bound within the major channel as highlighted.

Overall its not a clear picture at the moment. The potential for downside over the next couple of weeks appears real unless the market can find support around the 46,000 level again. If that support level fails the 45,300 area will be critical or we may see the triangle break highlighted above playing out and could well see the prior lows being revisited int he medium-term. On the flip-side, if the T40 could break and hold the 47,000 level, the bulls could force the year-end rally to play out with potential for further upside back towards historical highs. In the short-term we'll trade this analysis by keeping targets tight and fixed while we're in the 45,500 to 47,000 range for both longs and shorts. If we breakout of that range we'll be more inclined to let trades run.

Thursday, November 26, 2015

Netcare Short Setup

A 3LB breakdown on the daily charts setup took place today with short parameters as follows: Entry zone between R36.68 and R37.18 with a stop as a close above R37.68 and downside targets at R35.68/R34.68 and R34.18

Tuesday, November 24, 2015

Redefine Short Setup

Its been less than a month since the last (unsuccessful it must be said) trade attempt on RDF. Interestingly enough we now have a short setup in play as the 3LB breaks below its previous swing low. Entry zone is between R10.49 and R10.65 with a stop as a close above R10.80 and downside targets at R10.18/R9.87 and R9.72

Saturday, November 21, 2015

Top 40 Perspectives 21 November 2015

The market didn't play out as originally anticipated during last week's analysis with the T40 starting to work off the identified oversold conditions on a daily basis. The consideration at this point is whether there will be any bullish follow through as we head towards the end of the month.

Starting off with the weekly chart, we can see how price rebounded off the upper bollinger band but has now retraced to the 20 period moving average forming the center bollinger band where this line has created a confluence of support together with the 38.2% Fibonacci retracement level. The stochastic is not quite confirming a possible support bounce as yet although it has started working off its overbought condition.

On the daily view, the bounce out of oversold conditions is clearly shown as well as a bullish stochastic reversal playing out. We can also see a potential positive reverse divergence (as indicated by the blue lines) playing out.

The support and resistance on an end of day basis is seeing us approaching the 47,000 overhead resistance level and the first order of the week will be to see whether the Top 40 can break through this level with a positive daily close. Interesting to note that the recent reversal off the 46,000 level on an end of day basis coincided with the 61.8% retracement level. A solid break north here could see coinciding with the potential for a santa clause rally could see a move back to previous highs near the 49,000 level by the year-end on a more medium-term basis.

Putting all of this together, on balance the picture has shifted to a more bullish outlook with the key being the regaining of the 47,000 level as support early in the new week.

Starting off with the weekly chart, we can see how price rebounded off the upper bollinger band but has now retraced to the 20 period moving average forming the center bollinger band where this line has created a confluence of support together with the 38.2% Fibonacci retracement level. The stochastic is not quite confirming a possible support bounce as yet although it has started working off its overbought condition.

On the daily view, the bounce out of oversold conditions is clearly shown as well as a bullish stochastic reversal playing out. We can also see a potential positive reverse divergence (as indicated by the blue lines) playing out.

The support and resistance on an end of day basis is seeing us approaching the 47,000 overhead resistance level and the first order of the week will be to see whether the Top 40 can break through this level with a positive daily close. Interesting to note that the recent reversal off the 46,000 level on an end of day basis coincided with the 61.8% retracement level. A solid break north here could see coinciding with the potential for a santa clause rally could see a move back to previous highs near the 49,000 level by the year-end on a more medium-term basis.

Putting all of this together, on balance the picture has shifted to a more bullish outlook with the key being the regaining of the 47,000 level as support early in the new week.

Friday, November 20, 2015

Long setups on Tiger and Investec

3LB breakouts played out on TBS and INL yesterday. Will be looking for some intraday price pullbacks to enter.

TBS: Entry between R336.82 and R330.91 with a stop in as a close below R325.00 and upside targets at R348.64/R360.46 and R366.37

INL: Entry between R117.99 and R113.93 with a stop in as a close below R109.86 and upside targets at R126.12/R134.25 and R138.32

TBS: Entry between R336.82 and R330.91 with a stop in as a close below R325.00 and upside targets at R348.64/R360.46 and R366.37

INL: Entry between R117.99 and R113.93 with a stop in as a close below R109.86 and upside targets at R126.12/R134.25 and R138.32

Sunday, November 15, 2015

Industrials - Resources pairs trade

As set out in the perspectives note for this week, the overall market has experienced a substantial sell-off over the past week. While this has generally been felt across all sectors, what was notable was that resources were particularly heavily hit during this period while industrials, despite also experiencing a sell-off, not being impacted with the same level of severity. Consequently, looking at the pricing of industrials relative to resources (in this case dividing the Satrix Indi ETF price by the Satrix RESI ETF price), an interesting graph can be seen.

The graph above shows how the pricing of industrials relative to resources has pushed the relative ratio to a high of 2.54 during the course of last week. While this outperformance is really not unique, what is of interest is the huge surge over the past 2 weeks pushing the ratio outside of the upper bollinger band as well as the fact that following Friday's trading there seems to be a potential for a reversal in the making.

I also looked at graphs of the STXRESI and STXINDI individually. The STX RESI shows that the stochastic is oversold and has just crossed back over its signal line. This is accompanied by a long-tailed candle painting on Friday and we also see that volume has been declining during the tail-end of this sell-off - potentially indicative of seller exhaustion.

This seems to support a case for a reversal or at least a relative reversal being on the cards.

For the STX INDI while the stochastic is also oversold, it still remains pointed firmly downwards following a thick bearish candle being painted on Friday and conversely to the RESI graph, volume has also increased during the tail-end of this sell-off.

Trade setup as follows: Sell STXINDI at R71.23 and Buy STXRESI at R28.20 (Friday's closing prices) yielding a 2.53 entry ratio. The stop is a close above 2.6 (above the previous relative swing high) and the target is at 2.30 (close to the middle line of the bollinger bands). This yields a target reward-risk of 3-1

The graph above shows how the pricing of industrials relative to resources has pushed the relative ratio to a high of 2.54 during the course of last week. While this outperformance is really not unique, what is of interest is the huge surge over the past 2 weeks pushing the ratio outside of the upper bollinger band as well as the fact that following Friday's trading there seems to be a potential for a reversal in the making.

I also looked at graphs of the STXRESI and STXINDI individually. The STX RESI shows that the stochastic is oversold and has just crossed back over its signal line. This is accompanied by a long-tailed candle painting on Friday and we also see that volume has been declining during the tail-end of this sell-off - potentially indicative of seller exhaustion.

This seems to support a case for a reversal or at least a relative reversal being on the cards.

For the STX INDI while the stochastic is also oversold, it still remains pointed firmly downwards following a thick bearish candle being painted on Friday and conversely to the RESI graph, volume has also increased during the tail-end of this sell-off.

Trade setup as follows: Sell STXINDI at R71.23 and Buy STXRESI at R28.20 (Friday's closing prices) yielding a 2.53 entry ratio. The stop is a close above 2.6 (above the previous relative swing high) and the target is at 2.30 (close to the middle line of the bollinger bands). This yields a target reward-risk of 3-1

Hyprop long setup - another property trade attempt

With the increasing probability of a US interest rate hike on the cards for later this year, locally listed property stocks have experienced a substantial pullback over the past 3 weeks. I tried an unsuccessful 3LB long trade on Redefine (RDF) around the start of that pullback but now the stock that has caught my eye is Hyprop (HYP) which has also retraced along with the rest of the sector.

Starting with the longer-term weekly chart of HYP, we can see the 21 EMA well above the 89 EMA highlighting the major uptrend this stock remains in. The weekly stochastic has crossed below its signal line and is pointing downwards to be sure so the potential for further downside remains - however the stochastic itself is positioned in a fairly neutral zone.

The daily chart makes for more interesting viewing as here we can see the stochastic reflecting the reversal noted above but now starting to move back up from oversold conditions, crossing its signal line upwards on Friday. The daily candle also looks relatively bullish painting a semi-long tail and ending well off its lows for the day.

Finally the daily support and resistance view shows the stock hitting a relatively strong support level going back to the start of the year.

Some mixed signals particularly on the longer-term time frame so we'll look to trade this stock using 75% of normal risk size. Our setup will be to enter below R121.00 or better (around the current price)with a stop as a close below R118.00 (under the support level) and we'll look for a move back to around the R127.50 zone. This conservatively yields a reward-risk of 2.2-1 which could be improved by getting in at a better level and perhaps looking to exit closer to the R130.00 level. That latter element will be evaluated once the trade is entered but in the context of the overall market and taking quicker profits on the long side, its not an essential element of the setup.

Starting with the longer-term weekly chart of HYP, we can see the 21 EMA well above the 89 EMA highlighting the major uptrend this stock remains in. The weekly stochastic has crossed below its signal line and is pointing downwards to be sure so the potential for further downside remains - however the stochastic itself is positioned in a fairly neutral zone.

The daily chart makes for more interesting viewing as here we can see the stochastic reflecting the reversal noted above but now starting to move back up from oversold conditions, crossing its signal line upwards on Friday. The daily candle also looks relatively bullish painting a semi-long tail and ending well off its lows for the day.

Finally the daily support and resistance view shows the stock hitting a relatively strong support level going back to the start of the year.

Some mixed signals particularly on the longer-term time frame so we'll look to trade this stock using 75% of normal risk size. Our setup will be to enter below R121.00 or better (around the current price)with a stop as a close below R118.00 (under the support level) and we'll look for a move back to around the R127.50 zone. This conservatively yields a reward-risk of 2.2-1 which could be improved by getting in at a better level and perhaps looking to exit closer to the R130.00 level. That latter element will be evaluated once the trade is entered but in the context of the overall market and taking quicker profits on the long side, its not an essential element of the setup.

Top 40 Perspectives 15 November 2015

Last weekend's perspectives note played out during the course of the week as the T40 broke major support breaking to the downside. The weekly graph reflects how price reversed off the higher bollinger band as the stochastic crossed bearishly over its signal line. What now needs to be considered is the extent of the downward move. The stochastic still looks highly bearish and in this longer time-frame basis further downside appears to be on the cards.

The daily chart shows - via the stochastic - how oversold the T40 is following the last week's sell-off. However, at this stage there is really no sign of a reversal on the cards either in the slope of the stochastic, which is pointed firmly downwards, or in the daily candle formations which are very bearish.

On the support and resistance front, with the break of the support around the 47,000 level (now flagged as a red resistance line) we are now eye-balling the next support level at around the 45,300 - 45,500 level.

Putting all of this together to plan for the week ahead. At the outset we'd be looking to continue letting our shorts run as far and as hard as possible, treating any long trades as counter-trend and therefore taking quick profits if these setups do materialise. However if the market does start approaching the 45,300 level we need to be a bit more wary even on the short side as the sell-off has been fairly substantial so some consolidation could be on the cards around major support levels leading to choppiness. In that case, we'd look to take profits on short setups as well unless there's a decisive break of support .

The daily chart shows - via the stochastic - how oversold the T40 is following the last week's sell-off. However, at this stage there is really no sign of a reversal on the cards either in the slope of the stochastic, which is pointed firmly downwards, or in the daily candle formations which are very bearish.

On the support and resistance front, with the break of the support around the 47,000 level (now flagged as a red resistance line) we are now eye-balling the next support level at around the 45,300 - 45,500 level.

Putting all of this together to plan for the week ahead. At the outset we'd be looking to continue letting our shorts run as far and as hard as possible, treating any long trades as counter-trend and therefore taking quick profits if these setups do materialise. However if the market does start approaching the 45,300 level we need to be a bit more wary even on the short side as the sell-off has been fairly substantial so some consolidation could be on the cards around major support levels leading to choppiness. In that case, we'd look to take profits on short setups as well unless there's a decisive break of support .

Thursday, November 12, 2015

Coronation short continuation setup

3LB breakdown setup on end of day basis. Entry zone between R63.11 and R65.36 with a stop in as a close above R67.60 and downside targets at R58.62/R54.13 and R51.89

Wednesday, November 11, 2015

Nedbank, Billiton and African Rainbow short continuation setups

The market has taken a bit of beating over the past few days and technical 3LB short signals are popping out the woodwork at the moment. Here are the graphs of 3 signals currently in play (The 4th one was Lonmin but its in such a slump that the projected take profit point was negative - indicating that this one could well go bust pretty soon!)

Setup details:

ARI: Entry zone between R50.75 and R52.66 with a stop as a close above R54.57 and downside targets at R46.93/R43.11 and R41.20

: Entry zone between R199.35 and R204.08 with a stop as a close above R208.80 and downside targets at R189.90/R180.45 and R175,73

NED: Entry zone between R213.12 and R217.82 with a stop as a close above R222.51 and downside targets at R203.73/R194.34 and R189.65

A bit of caution in that there is a risk of overtrading and creating an over-concentration of risk - especially in the resource space if there are existing short positions, so a better tactic might be to choose between one of ARI or BIL to short here rather than both.

Setup details:

Monday, November 9, 2015

Northam Short Continuation setup

NHM 3LB looks to be be breaking down again. Entry zone comes in between R29.17 and R30.14 with a stop as a close above R31.11 and downside targets at R27.23/R25.29 and R24.32

Sunday, November 8, 2015

Top 40 Perspectives 08 November 2015

Last week we noted the following as our game plan : "On balance this leaves us with a short-term bullish bullish outlook out of the blocks but we will start exercising caution given the longer time-frame perspective if price starts approaching the 49,000 level again. So quick profits will be taken on positions to the upside and if/when we start commencing the downside move, we will let our short trades run as far as possible especially if we breakdown below the 48,000 level"

This played out almost exactly in line with expectation as the market first moved sharply higher breaking through the 49,000 level with this proving a false break as it then with a similar level of alacrity moved downwards ending the week in the red. Looking at the weekly candle, we see that reversal candle coming off the upper bollinger bad with the weekly stochastic now looking decidedly bearish as it looks to reverse form overbought levels.

On the daily chart, the week-end reversal is clear in Friday's bearish candle. The stochastic also looks like it has some room to fall as it moves downward.

The daily support and resistance doesn't add much to the analysis at the moment other than to highlight the fast-approaching major support level between 47,000 and 47,500 or thereabouts. Its going to be important for this to hold in the days ahead.

Our plan at the start for the week is then to again revert to quick profit taking on any long positions taken on the T40 with an eye on a break of major support which could see the flood-gates opening to the downside on the short-side.

This played out almost exactly in line with expectation as the market first moved sharply higher breaking through the 49,000 level with this proving a false break as it then with a similar level of alacrity moved downwards ending the week in the red. Looking at the weekly candle, we see that reversal candle coming off the upper bollinger bad with the weekly stochastic now looking decidedly bearish as it looks to reverse form overbought levels.

On the daily chart, the week-end reversal is clear in Friday's bearish candle. The stochastic also looks like it has some room to fall as it moves downward.

The daily support and resistance doesn't add much to the analysis at the moment other than to highlight the fast-approaching major support level between 47,000 and 47,500 or thereabouts. Its going to be important for this to hold in the days ahead.

Our plan at the start for the week is then to again revert to quick profit taking on any long positions taken on the T40 with an eye on a break of major support which could see the flood-gates opening to the downside on the short-side.

Thursday, November 5, 2015

Tiger Brands long continuation setup

TBS looks to be breaking out on the 3LB end of day basis again and with its annual trading statement likely to materialise in the near future, this could be a catalyst for the next move upwards. Entry zone is between R336.47 and R332.21 with a stop in as a close below R327.94 and upside targets at R345.00/R353.53 and R357.80

Barloworld Short Setup

With the 21 period EMA below the 89 period EMA on the weekly chart price is clearly in a longer-term downtrend at the moment. This is further supported by a bearish stochastic crossover which took place at the end of last week.

On the daily chart we can see evidence of an overbought stochastic starting to lose steam and moving downwards. Price has also retraced 100% from its previous major low. The daily candles are not fully convincing either way with the long tail and wick on today's candle reflecting a fair bit of uncertainty.

On the support and resistance chart we can see a relatively lateral resistance level in play and off which price appears to be reversing from around the R85.00 level.

BAW released a trading statement this morning and following an initial surge the market gave back its gains eventually closing in the red in line with the overall market.

Some mixed signals in this setup so we are going to grade the trade at 60% of risk value and will look for a quick bounce off resistance with an entry at around the current R84.00 level with a stop as a close above R85.00 and a target at R81.00 for a 3-1 target reward-risk

On the daily chart we can see evidence of an overbought stochastic starting to lose steam and moving downwards. Price has also retraced 100% from its previous major low. The daily candles are not fully convincing either way with the long tail and wick on today's candle reflecting a fair bit of uncertainty.

On the support and resistance chart we can see a relatively lateral resistance level in play and off which price appears to be reversing from around the R85.00 level.

BAW released a trading statement this morning and following an initial surge the market gave back its gains eventually closing in the red in line with the overall market.

Some mixed signals in this setup so we are going to grade the trade at 60% of risk value and will look for a quick bounce off resistance with an entry at around the current R84.00 level with a stop as a close above R85.00 and a target at R81.00 for a 3-1 target reward-risk

Subscribe to:

Comments (Atom)